At Bellatrix, we offer portfolio management services for private and institutional clients on a discretionary basis. Through a professional dialogue and highly specialised analysis of our clients’ objectives, we define together a profile and investment strategy corresponding to their needs. We are giving the comfort of mind to our clients that they can only focus on their other commitments, with a discretionary mandate service. After we agree with our clients on their expectations as well as their investment strategy, our dedicated management team take the whole responsibility of the day-to-day money management align with the clients objectives. We are constantly monitoring our clients’ portfolio in order to minimize the risk, by not only diversification but also by managing maximum drawdown.

We are in contact with our clients on a regular basis, to update them on the development of their portfolio. A three-party agreement is signed between the client, the bank and Bellatrix Asset Management. These agreements enable the client to enjoy advantageous conditions negotiated with the depository bank.

Our clients’ assets are deposited within wide range of depository institutions and private banks such as: Banque de Luxembourg, VP Bank, BNP Paribas, Spuerkeess, KBC, Deutsche Bank, Credit Suisse, Mirabaud and many more world wide.

At Bellatrix we make sure to:

- Understanding our clients’ expectations, wealth requirements and objectives in terms of performance and risk, and defining their investment profile.

- Rigorously selecting the shares, bonds and investment funds that best correspond to our clients’ investment profile.

- Controlling risks through diversification of strategies and underlying assets according to their risk profile.

- Communicating regularly through frequent reporting on your portfolio and constant exchange with your manager.

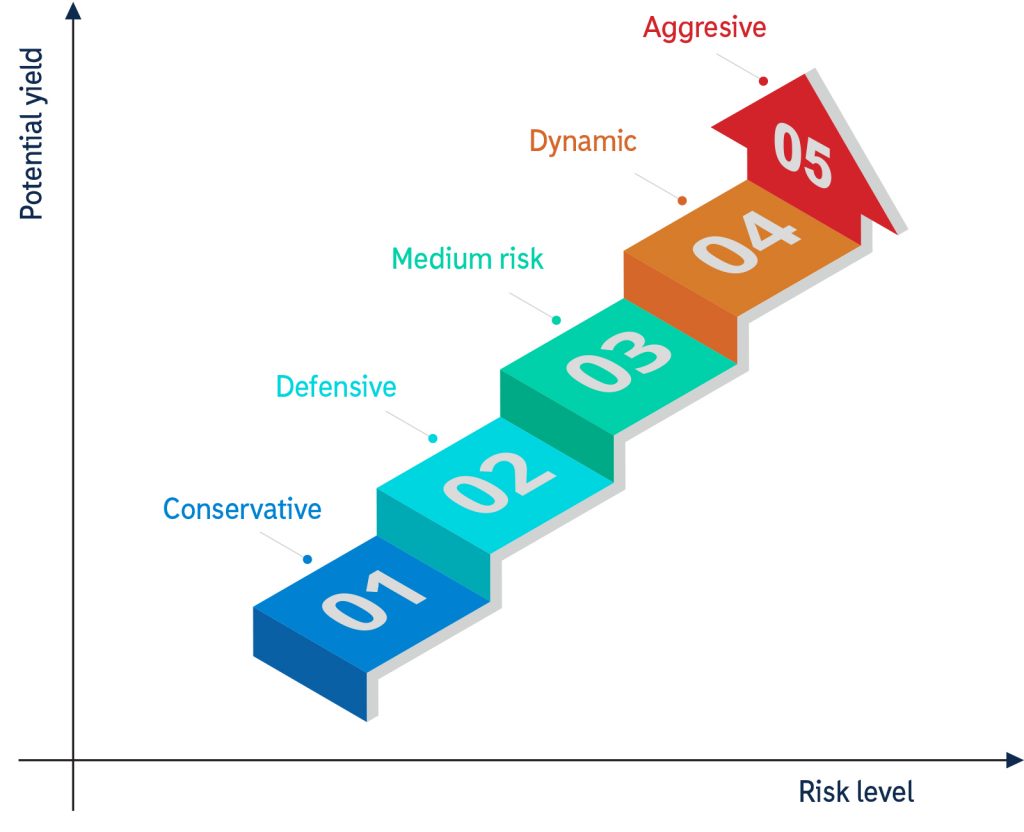

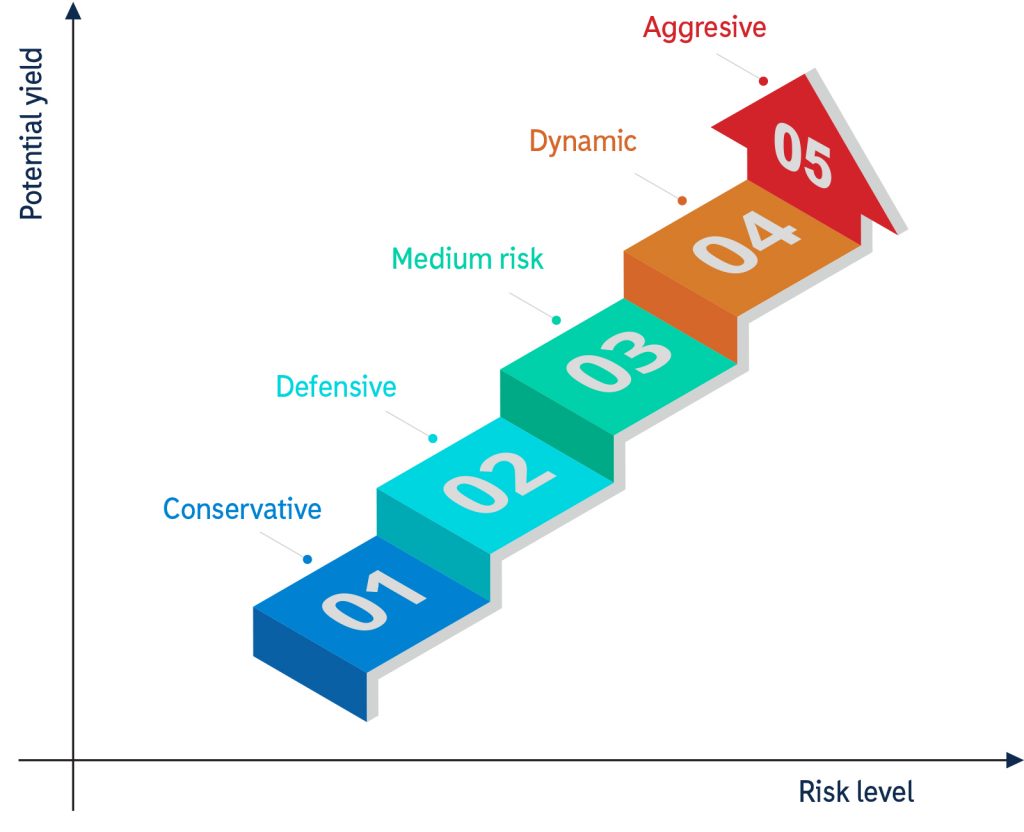

Investment Profile

Together with our clients, we define their investment profile according to their characteristics and investment requirements.

Bellatrix – discretionary mandate – investment profile

The Conservative Investor

Clients who opt for low‑volatility investments, which generate steady yields. Their portfolio comprises essentially bonds such as Government bonds, corporate bonds, bond funds or structured products that guarantee capital.

The Defensive Investor

Clients who wish to yield a profit from their capital but they are ready to stimulate their portfolio by taking risks limited to shares. Temporary volatility is possible following an increase in rates, exchange risk or a negative stock exchange climate.

The Medium‑Risk Investor

Clients which are looking for an attractive yield, combining security and growth, and they are willing to assume some risk on the share market.

The Dynamic Investor

Clients who wish to have a high yield over the long term. They are prepared to take high risks on the share market, which may, in the short term, result in high variations in the performance of their portfolio, even a negative yield in some years.

The Aggressive Investor

Clients who opt resolutely for a high yield over the long term. They are prepared to deliberately take high risks which may involve negative performances in their portfolio. This comprises essentially shares and share funds.

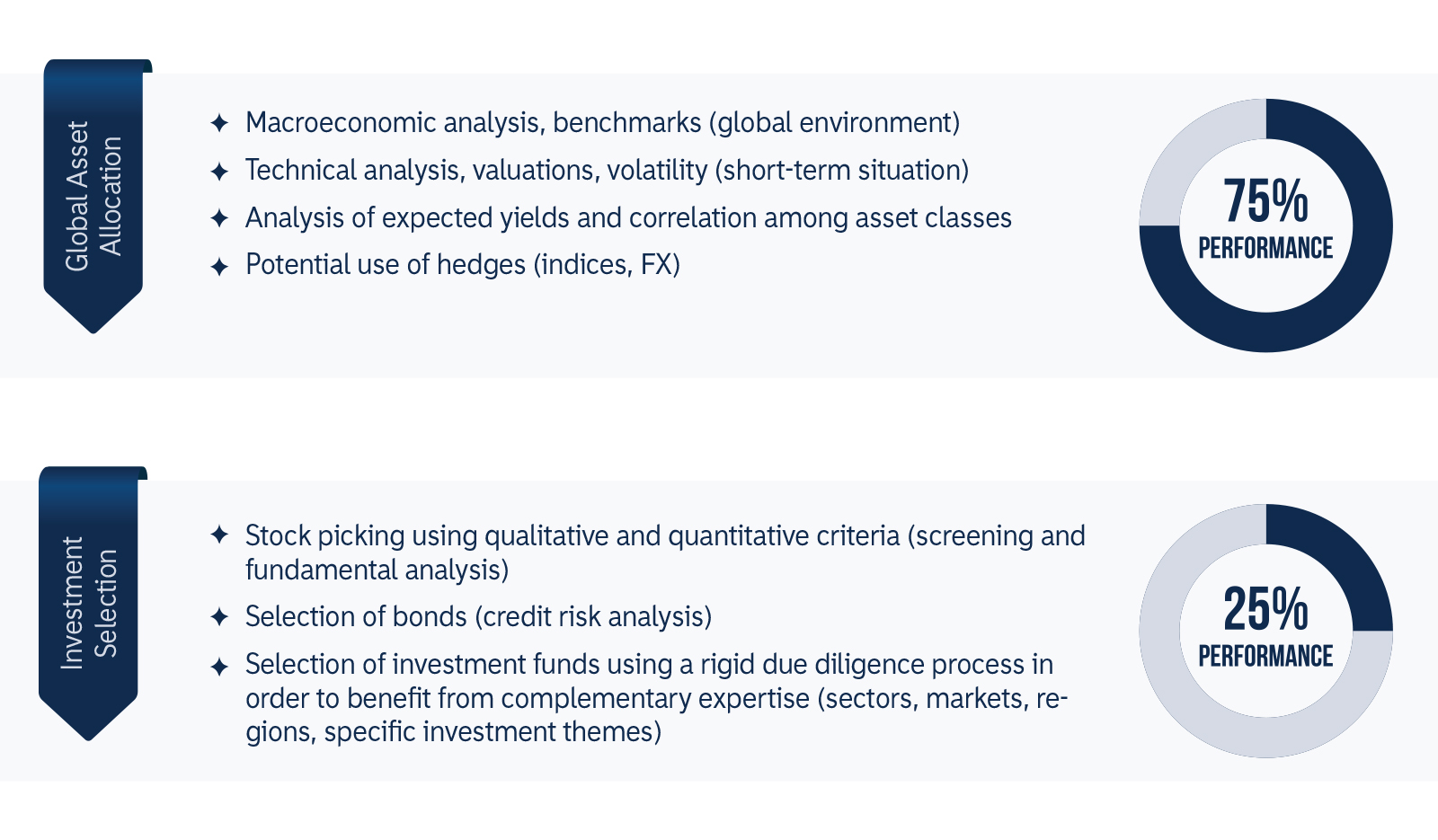

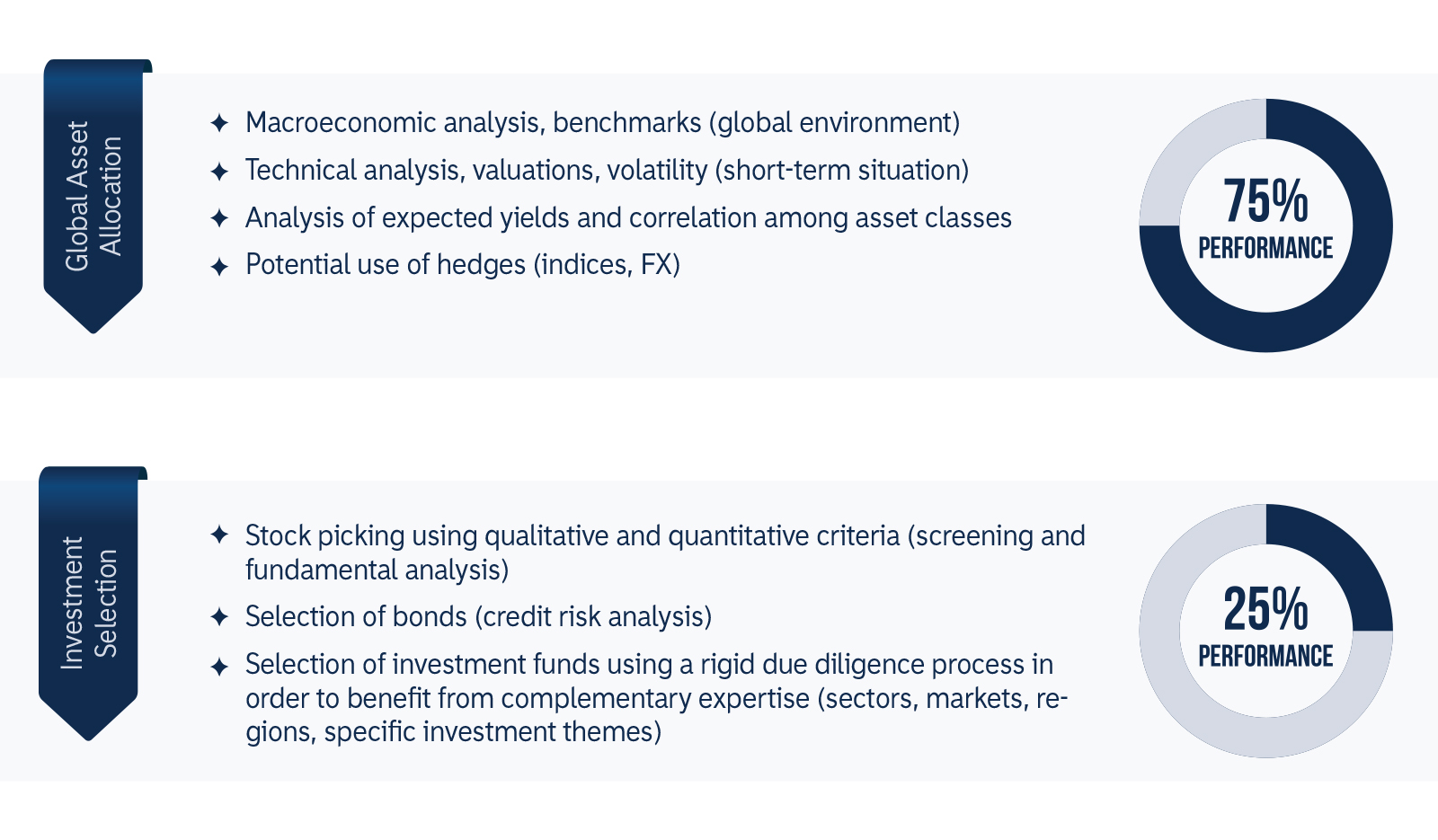

Investment Process

We favour a top-down approach. We believe that the general economic climate and strength of a given industrial sector have a considerable impact on the yield on securities.

The economic environment has a decisive influence on company profits and investor attitudes and expectations, and therefore on share prices on the stock exchange.