Fund Management

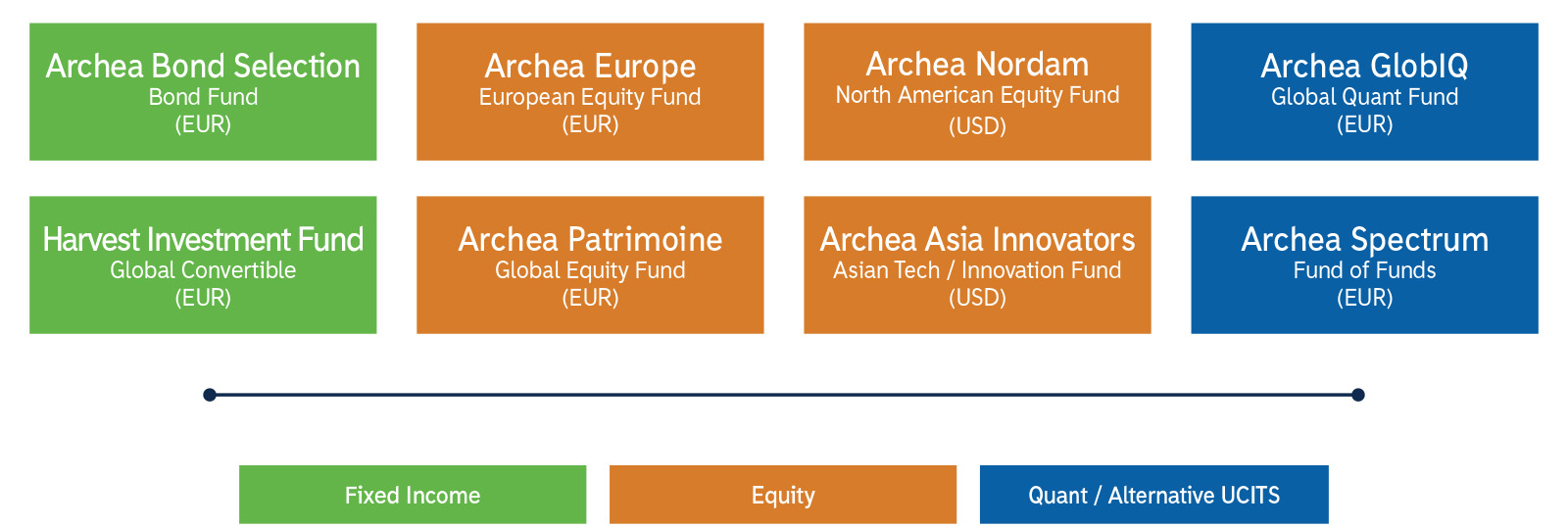

We are an independent investment management boutique, which entirely owned by its manager and employees. Our horizontal organization enables us to focus only on our clients rather than bureaucracy. We are specialists in both Fixed Income and Equities, which enables us to deliver a range of investment themes using different asset classes. The clients benefit from our interdisciplinary know-how directly within each product but form a sound and coherent diversification when allocating a portfolio. Our investment horizon spans several years to decades.

Thus, a quality approach is key for all our funds. Clearly, being invested ourselves in our products aligns our own interests with the interests of our clients.